Money Matters in Modi’s India

by Abhiram Muddu and Vince Wong

Abstract

Money matters in India are complicated. As Prime Minister, Narendra Modi has set forth bold policy objectives towards reining in sovereign liquidity, which has suffered in recent years due to declining money inflows and rampant tax evasion. In this article, we investigate India’s liquidity imbalances and explore the implications for businesses and entrepreneurs in an uncertain macroeconomic climate.

Background

Amid a backdrop of sustained GDP growth and cricket triumphs, India achieved a new kind of milestone in 2016. On November 8th, Prime Minister Modi addressed the nation in a televised announcement, declaring that all 500 and 1000 rupee notes (Rs) would cease to hold value on November 9th. Banks and other governmental bodies were instructed to reject the demonetized currency after December 31st. Rs 500 and Rs 1000 notes make up 86% of all currency in India, where more than 90% of all transactions are conducted in cash. [1]

There are several important drivers of this phenomenon. In India, sales are taxed at 15%, a rate that has skyrocketed in the past few years [2]. As the value of a transaction increases, individuals increasingly pay through unofficial channels to avoid incurring taxes. Taxable income is another dimension as only 1% of Indians pay any income tax [3], and all agricultural income is exempt from taxation. The estimated volume of unaccounted money in India ranges from $100 billion all the way up to $2 trillion. [4]

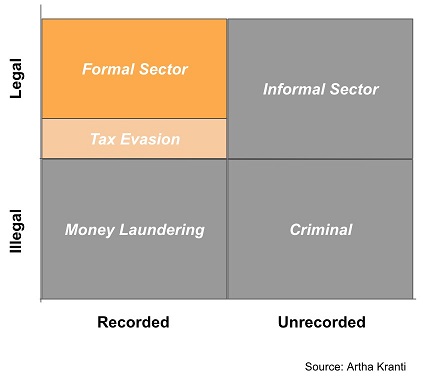

As Exhibit 1 shows, formally documented income represents only a small share of all income. Not surprisingly, illegal income is not reported as part of the GDP record, though a significant portion is tracked by investigative agencies who monitor money laundering activity. Even many legitimate revenue streams, such as grocery sales, are not recorded by the government.

Exhibit 1: Classifications of Income

Black money, which includes unaccounted (and thus untaxed) money and money sourced from illegal activities, is estimated at 75-200% of India’s GDP. Because black money is inherently opaque, accurate estimates are difficult to pin down and therefore vary widely. Black money is typically stored away via 4 methods:

1) In large sums of currency: typically Rs 500 and Rs 1000 notes (to make storage easier);

2) In the form of gold: the second best liquefiable asset (also storage is easier);

3) In the form of land: Land is registered with the names of friends, family, and trusted employees;

4) Roundtripping / Hawala transactions: The money is smuggled out of India and brought back legally through foreign corporations

Demonetization

Prime Minister Modi was voted into power in 2014 after 10 years of rule under the Indian National Congress party administration. One of the defining platforms of his campaign set out to uncover all of India’s black money and bring the corrupt to justice. On November 8th, 2016, in a televised broadcast, he announced a demonetization drive to flush out black money hoarders. In one fell swoop, $224 billion in value and 23 billion currency notes were deemed utterly worthless.[5]

After the broadcast, black money hoarders were given 3 days to exchange or return all of their high value currency either on the open market or at banks. After the first deadline, people could only deposit or exchange money with banks, governmental entities, and gas stations. Daily withdrawal and exchange limits were established, and individuals who deposited money in their bank accounts were asked to show proof of income while suspicious transactions were reported to the Income Tax authorities.

Chaos ensued across the country, with individuals unsure of how to manage deposits of the demonetized currency. Most people with illegitimate sources of income faced issues exchanging their unaccounted money, though some reported the money to the government in order to evade imprisonment and fees for holding excess cash.

There were 4 main impacts of demonetization:

1) Money flow was severely impacted across the country and most transactions came to a standstill by denial of service or sale by merchants, vendors, establishments, and companies;

2) The mandate came at short notice, and banks were unable to prepare for the resultantly long queues of black money customers;

3) The Indian stock market dipped by 6% following the ban. [6] This is primarily attributed to the fact that many private and public companies still transact in cash, and the impact of the ban was perceived to hit their balance sheets;

4) Ever since the demonetization move, India’s largest national bank, State Bank of India, has received more than $3 billion in deposits from its account holders and more than $15 billion has been deposited in various banks across India. This has presented banks with an opportunity to make short term investments with their enhanced liquidity.

Following these impacts, the key question now revolves around whether demonetization alone can truly turn the Indian economy on its head and meet the objectives set out by the government. We argue that the Reserve Bank of India and government should focus on sustaining the pressure that this move exerts on black money holders and corrupt individuals. As of November 8th, the government set a daily cash withdrawal limit of $40; however, this will revert after demonetization officially takes effect after December 31st. As a short term solution, the government could certainly maintain cash withdrawal limits in 2017 in order to provide users with reasonable access to liquidity. In the long term, though, this move would likely have an adverse impact on transaction volumes and cause macro-level ripple effects. We believe that shifting towards a cashless economy can better inform policy and alleviate the government’s current challenge of data visibility – that is, putting a name and face to the 86% of rupees floating on the market undeclared.

India’s Cashless Vision and Reality

Underlying the demonetization mandate is Modi’s ambitious vision for a cashless economy. Cash usage is disproportionately high as approximately 90% of consumer purchases in India are conducted in cash. While liquid, cash is an expensive proposition. In 2015 alone, the transportation of cash between villages incurred $335 million. [7] However, alternate tender types at their current rates are also costly – consumers commonly pay a 2% surcharge for credit card purchases. Most merchants today do not even accept card-based payments. Peer to peer payments are likewise obstructed by low adoption and awareness. Only 17% of India’s population owns a smartphone [8] and only 14% are familiar with P2P and mobile commerce. [9]

Compounding this issue, current banking infrastructure is inaccessible to the underserved despite attempts at reform. According to the World Bank, there are still only 18 ATMs for every 100,000 citizens in India. Additionally, the Indian government helped low-income consumers open 256 million bank accounts since 2014; yet, 23% of these accounts remain unused. [10] In addition to increasing contributions to the tax pool, demonetization is a bold step towards promoting other important governmental measures, such as increasing bank liquidity and reducing federal debt. However, as a standalone measure, it will be difficult to achieve these objectives without the appropriate banking and incentive structures in place.

Opportunity Areas

Going forward, there are 3 key opportunity areas where government officials and entrepreneurs can collaborate to motivate India’s cash-based population to adopt positive savings behaviors through government-sanctioned channels:

1. Subsidized Benefits – Currently, there are few perceived benefits that would entice Indian users to save at a bank or conduct cashless transactions, but that number is steadily growing following demonetization. As of December 13th, the government is providing a 0.75% discount on all fuel purchased with credit and debit cards, mobile wallets, and prepaid loyalty cards. Finance Minister Arun Jaitley also announced additional discounts on commuter tickets and insurance purchased from state-owned companies online. [11] The government could extend these benefits further by offering subsidized utilities, attractive borrowing rates, and even discounted education to users who save and go cashless. In exchange, the government would gain enhanced data visibility into how consumers behave financially, which would ultimately inform the policy schemes rolled out to help these very individuals. Because the vast majority of money is undeclared, the government has an incomplete view into the nation’s liquidity. Startups focused on fintech have an opportunity to pitch in with system design, build, and deployment in order to enable the government’s implementation of policy.

2. Informal Saving Methods – In rural areas and slums, two informal savings methods tend to dominate. Bhishi, or lottery-based savings pools, allocate funds to contributors on a rotating basis. Chit funds, on the other hand, also pool together funds but distribute money on an auction basis to the bidder willing to accept the lowest sum of money. The ‘winner’ sacrifices some portion of her principal and interest in exchange for instant liquidity, which would then be granted at a fraction of their original contribution. These informal savings schemes depend on the cooperation of all members to succeed, and are therefore unreliable. Startups have an opportunity to erode these ad hoc networks to bring these users into mainstream financial channels and provide access to financial literacy.

3. Transparency – The existence of black money was common knowledge well before demonetization; but, it was not highly actionable in the absence of a nation-sweeping mandate. As with cash, analog ledgers and paper-based land ownership deeds make it easy for individuals to ‘cook the books’. Startups have an opportunity to enable transparency by bringing outdated systems into the modern era; for example, converting physical documents to digitized assets or employing drones and satellites to map acreage in order to counter land ownership fraud.

Money matters in Modi’s India are complex. However, Modi has a unique opportunity to leverage startups’ accelerated time-to-market to foster a tech-enabled ecosystem that incentivizes users to adopt formal channels. Perhaps then, black money will emerge from the shadows. Working towards a cashless economy is a worthy goal, but the government cannot go it alone.

[1] www.bbc.com/news/world-asia-india-37974423

[2] www.tradingeconomics.com/india/sales-tax-rate

[3] www.cnbc.com/2016/05/03/guess-how-many-people-pay-taxes-in-india.html

[4] www.bloomberg.com/news/articles/2014-06-08/hidden-assets-seen-worth-2-trillion-targeted-by-india

[5] www.forbes.com/sites/wadeshepard/2016/11/25/the-on-the-ground-impact-of-indias-earth-shattering-currency-purge/

[6] www.livemint.com/Money/WZMX0fj5YQKOU4l6P0J44I/Demonetization-of-rupee-has-hit-the-Indian-markets.html

[7] www.bloomberg.com/view/articles/2016-07-21/india-s-cashless-future

[8] www.pewglobal.org/2016/02/22/smartphone-ownership-rates-skyrocket-in-many-emerging-economies-but-digital-divide-remains/

[9] www.mobilereadiness.mastercard.com/

[10] www.bloomberg.com/news/articles/2016-12-04/cashless-economy-still-a-fantasy-for-indians-snubbed-by-banks

[11]http://www.hindustantimes.com/business-news/starting-today-get-0-75-discount-on-cashless-fuel-purchases/story yCLnqxfMatdg3Yu96HW56K.html