An Overview of Brazil and Mercosur: A Consultant’s Perspective

An interview with Leticia Costa, MBA ’86, former Vice President at Booz and Company and head of consulting in Brazil

An interview with Leticia Costa, MBA ’86, former Vice President at Booz and Company and head of consulting in Brazil

by Ian Martins Shih, MBA’14

In an attempt to better understand my country and increase awareness of Brazil (and by association the greater Mercosur region) as a growing economic power, I interviewed Leticia Costa, former Vice President at Booz and Company (and now renamed Strategy& post-PWC merger) and head of consulting in Brazil. Leticia spent 24 years in Booz, sits on several boards and is now the Dean of Graduate Studies at Insper (Institute of Education and Research) in Sao Paulo:

EMI: What are some of the most critical factors to be aware of when doing business in Brazil?

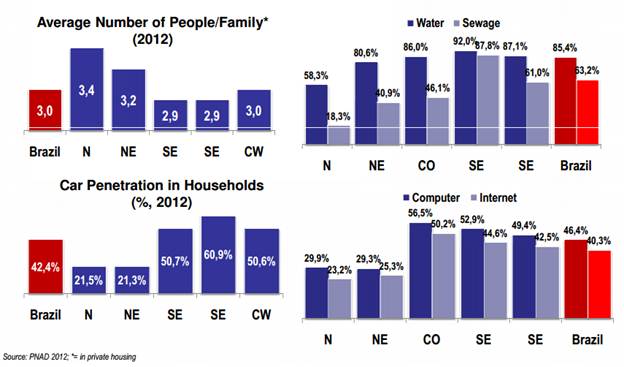

Leticia: Obviously there are no sweeping statements that can be made, as this is very industry specific. The industries that are more dependent on governmental intervention, such as shipping and telecom, have to be aware of the many layers of bureaucracy and rampant corruption in governmental institutions. The industries unrelated to government have to understand the volatility of the economy and the diversity of the country. Many companies come into Brazil with a “Brazil strategy”, but what they don’t understand is that Brazil is a huge country with tremendous differences in consumption patterns, preferences, geography, and income from region to region (Appendix 1). The logistical challenge in a country with relatively poor infrastructure (Appendix 2) is considerable, and the cost of conducting business varies accordingly.

Economic volatility affects the interest rates and exchange rates wildly too, and although the exchange rates have held pretty stable in the past couple of years, history shows that this is more likely not sustainable.

EMI: Can you point out some of the biggest differences you perceived in consulting for Brazilian/Latin companies versus consulting for American/Western companies making their incursion into Brazil?

Leticia: I would categorize them broadly as follows:

- Americans are more aggressive and proactive in effectuating change; they are unafraid to drive top-down changes.

- Europeans are a bit slower, more methodical in their approach to problem-solving and change implementation. This process-oriented approach sometimes gets companies in trouble when urgency exists.

- Japanese companies operate on very long-range plans, which is very challenging in Latin America. For example, a Japanese automaker once approached us and requested a forecast for the Brazilian auto market for the next 20 years. This is impossible to do with any kind of accuracy due to the volatility mentioned before. Many Japanese companies try to apply Asian businesses values and principles in their Brazilian operations and have a hard time given the vast cultural differences.

- In Brazil, personal relationships matter more, and employees respond well to camaraderie. Brazilian companies are very hybrid in that they have no fear of change due to past volatility in the country’s political and economic climate, and can make quick, if not always the best decisions. Brazilian companies operate on more short term views, due to unpredictability of even the near future.

EMI: What do you think are some of the most important trends in Brazil for both foreign and domestic companies to be aware of?

Leticia: I can think of two main trends that are continuing to make Brazil an exciting destination for foreign companies:

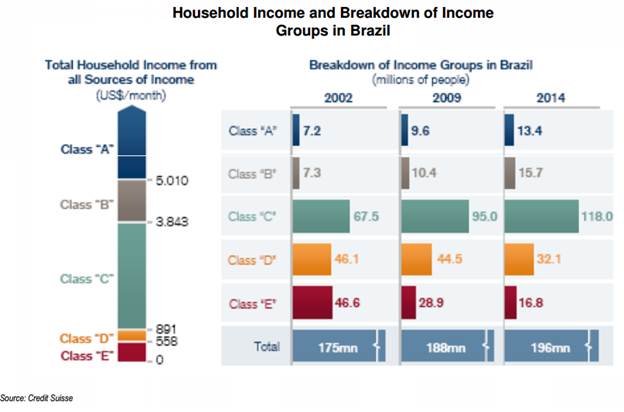

- The biggest trend is the growth of the middle class (Appendix 3). While the Brazilian middle class is by no means affluent in light of high inflation, it has a high affinity for consumption and high desire to “announce their arrival” as potential consumers. Here too, a large diversity exists in spending habits and income (Appendix 4).

- The other related trend has been the increasing interest in technology. The trend has been, and will continue to favor mobile over PC/laptops. Brazil has a 50% PC/laptop penetration, while mobile penetration is already higher than 100%, with more than 1 phone per person on average. Among these phones, the share of smart phones and tablets is rising rapidly, which bodes well for companies trying to take advantage of online operations. A majority of this penetration is in urban centers, but the share of urban population in Brazil is also quite significant at 84% of the population.

EMI: What are the main advantages of operating in Brazil?

Leticia: Brazil has two main advantages over many other emerging market countries:

- Size of the market: Brazil is the 8th largest consumer market in the world including top 5 for many products. The large population (196 Million as of 2012) and growing middle class should only help propel this ranking further. (Appendix 3)

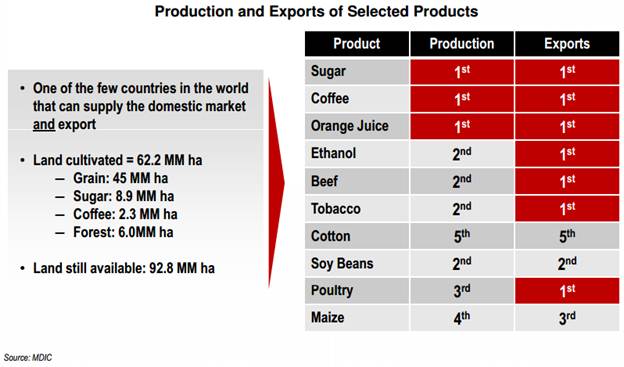

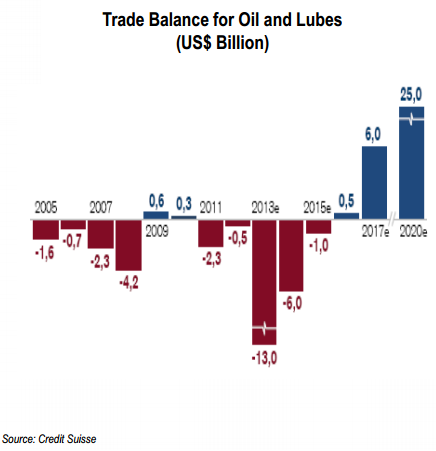

- Comparative advantage in terms of natural resources: Brazil is already one of the most resource rich countries in the world (Appendix 5) and this was further made true with the discovery of a large petroleum deposit off the coast of Rio in 2006. Brazil is even projected to become an oil exporter in the next few years (Appendix 6). All this means that manufacturers can source most raw materials locally, and that the nation is about to become more prosperous.

EMI: How does the opportunity in Brazil compare to the rest of LATAM?

Leticia: Because Brazil is far and away the biggest consumer market in LATAM, it is still the dominant presence in the region. The other nations provide much smaller opportunities while carrying a lot of the same challenges as Brazil, namely corruption and governmental regulations.

In terms of market entry, Brazil is no more difficult to enter than anywhere else in the region. In terms of regulations and market conditions, Uruguay is probably the friendliest to foreign entry, but Uruguay is a small country of 3 million people that is a decent point of entry into Argentina but not into Brazil. I would rank Brazil as the #1 target followed by Argentina. It is also important to note that Argentina has been on an economic downward spiral for almost a decade now, with no end in sight.

EMI: Were you ever hampered by corruption or excessive bureaucracy in Brazil? How did you deal with it?

Leticia: Only one incident comes to mind: We were doing a proposal for a government project and our contact approached me and said, “If you employ the services of x as a subcontractor, you will be guaranteed to win the bid”. We responded with the only available reaction to a request for corruption: We said no and walked away.

EMI: Do you still agree that Brazil presents a huge opportunity for the future or does the sub-3% growth of the past couple of years suggest otherwise?

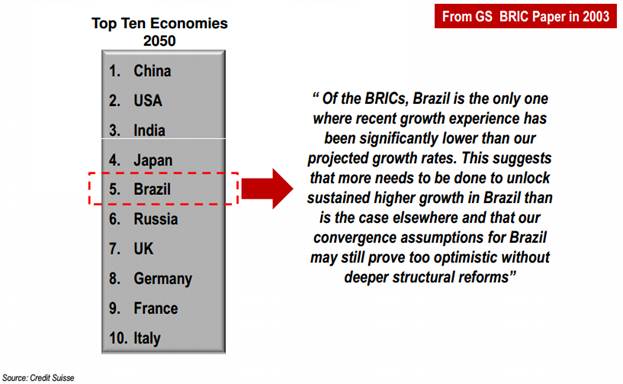

Leticia: The perception of Brazil as a bastion of growth was always an unsustainable mirage. Brazil cannot have sustainable growth without first fixing its poor infrastructure and installing a more competent, less corrupt government. (Appendix 7)

I should add that this is true to a degree of most other BRIC representatives: Russia’s growth has been sub-3% in recent years and does not have an optimistic outlook in light of recent alienation of the west. India, despite its large population, actually has a much smaller consumer market than Brazil.

EMI: Lastly, what advice would you give to aspiring consultants or business people who want to practice in Brazil?

Leticia: First, they need to understand that Brazil is a complex country before they go in. It’s crucial to be aware of the regional differences and have a solid expansion plan that does not ignore this diversity.

Second, be prepared for Brazil’s economic volatility: It’s a country where if you’re good during the good times, you can make more money than in any many other countries, but where if you’re good in bad times you will make a lot less. The company needs to have a solid operation and never get careless during the good times because the bad times are always just around the corner.

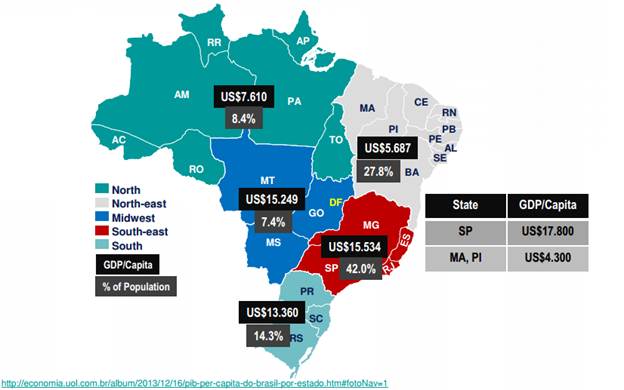

Appendix 1: Brazil’s Diversity

This chart displays some of the inequities that exist among Brazil’s different regions. The GDP/capita inequity also reflects inequities in average salaries and quality of infrastructure available locally.

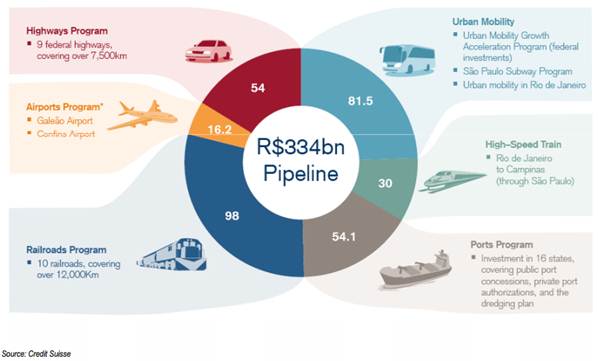

Appendix 2: Infrastructural Shortcomings

Brazil’s infrastructure not only trails developed countries by a wide margin, but also other developing countries like India and Poland. Especially considering all the government spending during World Cup preparations, the shortcoming in crucial infrastructures like airports is alarming.

But, this also creates opportunities through privatization:

Appendix 3: The Growth of the Middle Class

The data below shows conclusive evidence that there has been a considerable upwards shift in income by the Brazilian populace. However, the concurrent rapid inflation is keeping purchasing power still relatively low.

Appendix 4: Consumption Diversity by Region

Evidence of diversity in consumer behavior by region in Brazil; the North and Northeast regions are significantly poorer than the Southern regions and would require unique strategies for companies to penetrate, especially considering the lack of online connectivity.

Appendix 5: Strength of Brazil’s Agribusiness

Data below shows Brazil’s strengths in agribusiness via selected world rankings. In addition to being mineral rich, Brazil is blessed with mostly fertile soil and an extensive network of rivers, which makes it a powerful agricultural producer despite the lack of infrastructure and cogent governmental support.

Appendix 6: Oil Dependency Projection

Brighter outlook: While Brazil has been a net importer of oil leading to a heavy burden on motorists and government alike (price of diesel is highly subsidized by the government to help the trucking industry), the exploration of new large oil reserves off the coast of Rio projects Brazil to become a major exporter by the end of the decade…

Appendix 7: Sign of Trouble?

…but governmental ineptitude and corruption keeps getting in the way of Brazil’s sustained economic growth. Until the government starts acting to clean up corruption and bureaucracy, Brazil’s “promise” will remain just that, a dormant giant never to be awoken.