Tanzania unleashes tax on tourism

Tanzania´s New VAT tax on Tourism could Potentially Slowdown an Otherwise Thriving East African Country

Tanzania´s New VAT tax on Tourism could Potentially Slowdown an Otherwise Thriving East African Country

by German Peralta

On July 2016, President John Pombe Magufuli of Tanzania imposed an 18% VAT tax on tourism activities, a sector that was previously tax exempt and was one of the primary drivers of the country´s accelerated GDP growth. This decision came with a week´s notice and threw the country´s safari industry into an absolute pandemonium, as per the British journal, The Telegraph. This decision poses a challenge for Tanzania´s growth for three main reasons: First, the country´s accelerated GDP growth was leveraged by the increased growth of this sector, which was in turn fueled by positive global tourism industry trends; Second, other African countries like Kenya and South Africa offer similar tourism experiences at a significantly lower price; Finally, President Pombe installed the new measure in the hopes of increasing tourism monetization. However, the government failed to assess the endless monetization opportunities that the country has yet to explore as its tourism facilities are still rather precarious.

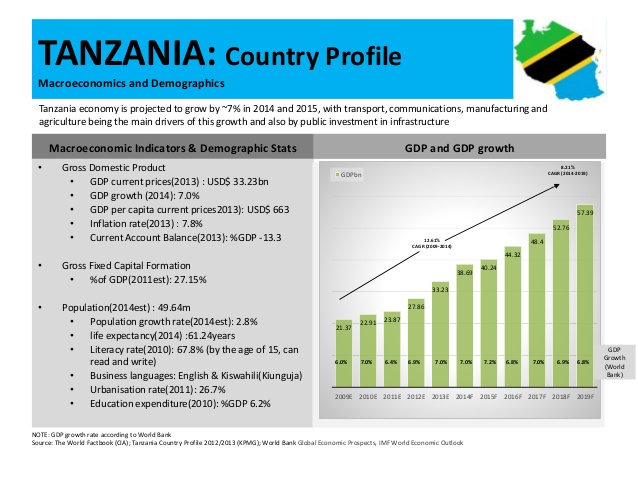

It is important to assess the importance of the tourism industry for Tanzania´s economic development. Tanzania is the second largest economy in East Africa and the twelfth largest in Africa. Half of its GDP is based in services, of which the major driver is tourism, accounting for ~13% of GDP. The agriculture sector amounts to about a quarter of GDP and is primarily driven by exports of cloves that are harvested mainly in the island of Pemba. This sector employs 80% of the work force but has consistently underperformed growth expectations as all land is owned by the government, thus preventing private investments to fertilize land in a country where only 16% of the land is arable. Finally, the major industrialized sectors of the economy—i.e., the mining of tanzanite and diamonds, as well as the production of natural gas and electricity—account for a quarter of GDP as well.

Tanzania´s GDP per capita has seen a consistent real growth of ~3% over the past three years. According to the international monetary fund, Tanzania has increased its GDP per capita ranking from the 168th position in 2010 to the 158th position in 2016. This has been primarily driven by the number of tourists visiting the country and by this sector-increased contribution to the economy since all tourist prices are quoted in foreign currency. The number of tourists a year doubled from 500 thousand in 2005 to 1 million from 2005 to 2012, the vast majority of which are attracted to Tanzania for its “Northern Circuit of National Parks” such as Serengeti, Ngorongoro, Taragire, Lake Mayara and Kilimanjaro National Parks. Additionally, in 2013, the World Bank´s Africa Tourism Report ranked Tanzania as one of the five countries with the highest potentials for tourism, signaling that the annual growth potential could be as high as 20% per year. This motivated the government to launch a 18% VAT tax on all tourism activities mentioned above, with the aim to increase tax revenue from the tourism industry.

Tanzania has always been a premium location for safaris. Its Northern Circuit offers an unparalleled opportunity to see “The Big Five” African mammals. This has justified the average increase price of 5-7% relative to countries like Kenya and South Africa. The price increase has been sustainable despite significantly easier travel to English speaking African countries, more frequent flights, better infrastructure and superior quality of the facilities. Now, the increased VAT is likely to widen the price gap to 22-25%.

When visiting Tanzania, tourists can also visit Zanzibar, whose beaches are a great appeal to tourists. Zanzibar has been a good selling point notwithstanding its precarious airport and the inaccessibility of the island from the parks via ground transportation. South Africa offers a similar experience in Cape Town’s neighboring resorts but with a top of the line airport and culinary offering. Still, with no plans from the government to bridge current service gaps, it seems difficult that the country could sustain a 25% price premium over similar tourism offerings in other sub-Saharan African countries, keeping in mind that a week safari ranges from 1,400 to 2,500 USD.

It is easy to see that basic revenue drivers for tourism like restaurants, gift shops, snack shops are practically nonexistent. Indeed, most of the country is employed by agriculture and this sector is experiencing a decline in demand. Thus, subsidizing taxable private businesses or even creating government owned companies to serve international tourism could potentially increase revenue and foment employment. The current Minister of Tourism has helped expand the product offering for hospitality within the natural parks. Tourists can now stay in government-owned safari lodges that offer a 5-star service. However, they still lack additional services like massages, hot tubs, business centers, among others. Including these services could provide opportunities to attract price inelastic users, a major issue of the increased tax applicable to all tourists visiting the country. Overall, there are endless opportunities that would likely generate more revenue than the 18% increased tax proposed by the government.

Mr. Pombe´s new VAT plan not only poses a threat for the position of the Tanzania´s tourism industry, but might also decrease the income generated by tourism due to the increased competition for the same offering. What is more, the unilateral decision has driven local tour operators away at a time where relations had improved after the Minister of Tourism revamped all key parks and as Kenya and South Africa aggressively promote their own products. Mr.Pombe’s decision risks strengthening these countries’ brand equity to foreign travelers. Mr. Pombe should consider working with the Ministry of Tourism to increase revenue streams and to set growth targets consistently. He might be more successful in achieving increases in revenue by attracting less price sensitive customers who spend their money on other activities.