Colombia: Ripe for Private Equity

Until late 2016, PE activity was dominated by Brazil, but recent political events, instability in Brazil, and the FARC-Colombia peace deal makes Colombia a lucrative opportunity for PE investment.

by Srini Chandrasekharan, AMBA ’17

Latin America (LatAm) has seenextraordinary growth in entrepreneurship, and flow of investment in privateequity (PE) since 2005. From only two funds in 2005, 2014 ended with 55 fundsoperating in Colombia in sectors ranging from mining to financial &business services. While 2015 saw an overall decrease in M&A activity inLatAm, PE activity across LatAm increased in 2015, with firms announcing US$7.5B in new investments which was a noticeable increase relative to 2014. Itis also interesting to note that until late 2016, PE activity was dominated byBrazil, but recent political events, instability in Brazil, and theFARC-Colombia peace deal makes Colombia a lucrative opportunity for PE investment.

Potential Growth of PE in Colombia

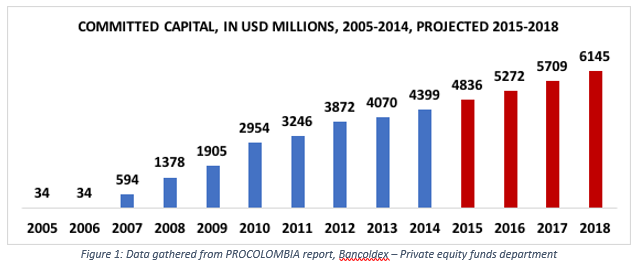

A report from PROCOLOMBIA in 2016showed strong growth in capital committed to PE since 2005. Using similargrowth rates and projections, 2017 and 2018 are expected to show furtherincreases in capital committed to PE in Colombia. While the amount of capitalseems low, sectors like energy, tourism, forestry, agro-industry, and ICTsamong others offer investment opportunities with good rates of return. Thereport further shows that the constant increase in committed capital has helpedColombia move in the Latin American Private Equity & Venture Capital(LAVCA) rankings. It was ranked in 7th place in 2006 and by 2010 it hadinched up to the 4th place.

Economic Conditions in Colombia

Using GDP data since 2005,Colombia has been growing at a steady pace between 3.5 – 4.0%, except for 2009when the GDP growth was recorded as 1.6%. Though the GDP growth rate has fallento about 1.7% since 2015, it is expected that the Colombian economy will growat 2.5% in 2017 even when LatAm has had negative GDP growth for both 2016 and2017. The FARC peace deal will boost economic activity in Colombia and willhave a positive impact on the GDP. Reports also show that inflation in Colombiahas been controlled and has remained steady at around 3.6%. There has also beena reduction in unemployment rate to 8.9% in 2015. Colombia also has afast-growing middle class population which comprises of 37% of the 48 millioncitizens. All the above factors point to a dynamic long-term economicperformance.

Regulatory Framework

According to reports, Colombiahas generated interest among investment funds and facilitated, and boosted thePE industry by creating a regulatory framework for the creation and managementof PE firms. Decree 1242 of 2013 replaced the previous regulations regarding theadministration and management of investment funds by removing restrictions onlocal institutional investors to invest in PE. Colombia is also internationallyrecognized for protecting its investors and was ranked 6th in theworld and 1st among LatAm countries, according to Doing Business.

Access to Capital Markets

Since 2007, changes inregulations have also allowed pension funds and insurance companies to investin PE funds, and they have had good returns and are considering higher ones.With the implementation of the multi-fund system in 2011, smaller pension fundsare also allowed to put part of their funds into PE and high risk funds. Thistoo has increased access to capital for the new and upcoming PE funds. Theintegration of the stock exchanges of Colombia, Chile and Peru in the last fewyears has also increased the availability of capital and exit opportunities.

Investment Opportunities

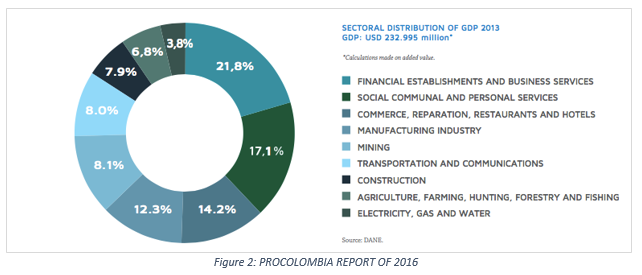

Colombia has a diversifiedeconomy with investment possibilities in various sectors. The PROCOLOMBIA reportof 2016 shows the wide variety of sectors that PE funds can invest in. It isinteresting to note that no sector dominates and variety allows PE funds totarget sectors in which they feel they have a strong know – how. Some of thesectors are health, software and IT, tourism infrastructure, agriculture,energy, infrastructure, and innovation projects.

Opinion

With the steady economic growthof Colombia and the improved regulatory framework, and better access to capitalmarkets and investment opportunities, I can say that Colombia is ripe forprivate equity investment. One of the topics not covered in this article is theeffect of entrepreneurship on family businesses. Like any other developing andemerging economy, the majority of Colombia’s small businesses are family ownedand operated. These businesses have excellent cash flows, and the nextgenerations of owners want to make some changes. These small businesses areexcellent targets for private equity because of their steady cash flows andwillingness of the owners to sell their stake. The next big wave of large PEfirms will be in Latin America and the destination is Colombia.

References

1. http://www.investincolombia.com.co/sectors/services/private-equity-funds.html

2. EY Report – Private Equity roundup Latin America

3. Bancoldex, IDB (Inter-American Development Bank), OMIN (Multilateral Investment Fund Member of the IDB Group) – Private Equity and Venture Capital Funds Colombia 2015 – 2016

4. Colombia’s Private Equity Evolution – Isabella Munoz, ColCapital