Latin American Political Scenario in 2018

by Evodio Kaltenecker

Introduction

Democracies in Latin America await a wave of important elections in 2018. Starting in Costa Rica, with presidential and legislative general election on February 4th, and El Salvador, which will face legislative elections on March 4th, to several other countries in the region, which will cast votes for their legislative branches, in addition to both state and federal-level offices. Colombian voters will face the ballots on March 11th, May 27th, and June 17th, for legislative, as well as presidential elections (first round and second round, respectively); Paraguayans will vote for president and for Congress on April 22nd; and Mexicans will have their own opportunity for presidential and general elections on July 1st. Finally, the 2018 electoral spree will end with Brazilians voting for general legislative elections and the first round of presidential elections on October 7th followed by the second round on October 28th.

However, there is one important aspect that sets the 2018 elections apart from previous ones: an expected pro-market wave that has been identified by politicians, financial agents, scholars, and political analysists altogether. The recent rise of market-oriented candidates has been attributed not only to a series of corruption scandals that involved leftist officials in many countries but also—and perhaps most importantly—to the poor economic performance presented by the countries that supported government interference in the economy.

The new economic-political momentum started with 2015 presidential election in Argentina, which elected Mauricio Macri, a businessman with an economically liberal background. Elections held in 2016 in Brazil reinforced a market-oriented trend when the main cities elected mayors that presented free-market ideals. Chile, in 2017, gave Sebastián Piñera, another businessman, a second opportunity as president. The elections ahead in 2018 may reinforce a shift from a state-oriented growth mentality (a mainstream economic approach in Latin America since the early 2000s) to a liberal-style, market-oriented philosophy. Brazil´s Dilma Rousseff, Argentina´s Cristina Kirchner, Venezuela´s Hugo Chávez and his successor Nicolás Maduro were the most prominent examples of political leaders that were adept at the expenditure-led growth.

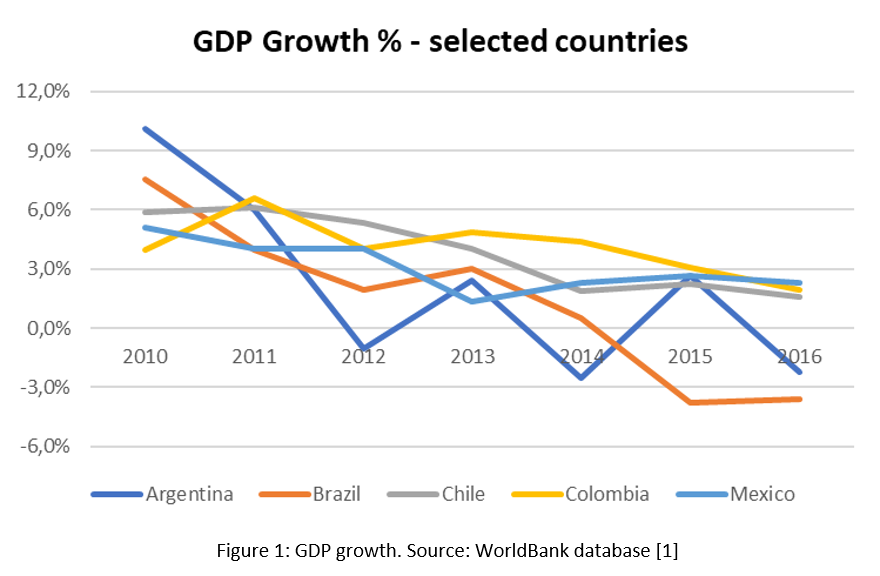

However, the economies of their countries did not grow as expected. Rather, the largest economies in the region observed economic contractions [3]. Figure 1 shows GDP growth for selected countries in Latin America.

What are the impacts of 2018 in Multilatinas and in their internationalization process?

What can go right?

To evaluate if the still-to-be-confirmed 2018 pro-market wave will benefit Multilatinas is difficult since some multinationals, mostly from Brazil (JBS, Petrobras, Odebrecht, Camargo Correa, to name a few), were already strongly subsidized. However, some analysts project that pro-market policies show promise in reducing barriers for Foreign Direct Investment (FDI) and in boosting investment in fixed assets (equipment, machinery, plants). New equipment, they argue, improves efficiency and innovation capabilities of the emerging markets multinationals (EMM) which, in turn, build on innovation to explore new markets and fuel internationalization. Consequently, in case the political spectrum in Latin America bends towards market-oriented reforms, Multilatinas are expected to be better positioned for expanding their internationalization.

Another prospect of a liberal wave in Latin America is the potential shift in the role of Mercosur. Originally, the institution was created to improve trade not only among its members but also to increase trade with other economic blocs, most notably NAFTA, European Union, and APEC. However, due to political challenges in the administrations of former Latin American leaders Mercosur failed to reach its original goals.

What can go wrong?

Even in the event that pro-markets candidates win the elections in Mexico, Brazil, Colombia, much-need reforms are still uncertain depending on public opinion among the Mexican, Brazilian or Colombia electorate. Improvements in the economy will likely play an important role. In case economic growth does not meet expectations, the political conditions may deteriorate, which risks favoring short-term, populist actions rather than long-term, structural reforms.

Conclusion

“There is nothing more difficult to take in hand, more perilous to conduct, or more uncertain in its success than to take the lead in the introduction of a new order of things.” (Niccolo Machiavelli, The Prince, 1532)

In the early 2000s, Latin American economies faced a period of economic bonanza due to increased demand for commodities, favorable financial markets, and strong global trade. Growth was led both externally, due to the commodity boom, and internally, due to high government expenditure model. The auspicious conditions did not last and in the ensuing decade these economies observed disappointing economic growth. Their societies seem now to be pivoting towards orthodox, liberal economic models. The set-up of effective, pro-market policies in the region is a phenomenon to be confirmed, but dissatisfaction with feeble economic growth has at least set the scene for the rise of a clear wave of change across Latin America.

References

[1] WorldBank: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG, accessed by January 1st, 2018

[2] and [3] Foreign Policy: https://foreignpolicyblogs.com/2016/01/22/the-recession-in-latin-america-will-transform-its-geopolitics/ , accessed by January 1st, 2018

[4] Investopedia: https://www.investopedia.com/articles/04/051904.asp , accessed by January 2nd, 2018