High stakes at the Johnson Stock Pitch Challenge

By Jonathan Woo, Two-Year MBA ’20

For students interested in pursuing a career in investment management, stock pitch competitions are one of the most useful resources to take advantage of during business school. Across all competitions, students get the opportunity to network with like-minded students at other top programs, pitch their ideas to a panel of esteemed judges (most of whom are industry professionals), and experience what it’s like to be an equity analyst. That said, Johnson’s MBA Stock Pitch Challenge is uniquely structured to replicate a critical element of an analyst’s life: incredible time pressure.

Crunch time

On Tuesday, my teammates—Raheel Hirji and Emma Liang—and I were sent an email at 9 a.m. that included a list of companies that we could pitch. One stock was mandatory, but we had to choose two other stocks from a list of companies in two different industries (one stock per industry). When we received the email, I quickly scanned the list in hopes that I would find a name that I already knew about. The mandatory stock was an education technology company, and the two industries we had to choose from were (1) aerospace & defense and (2) property & casualty insurance. Collectively, we knew nothing about any of those industries—yikes. To get ourselves up to speed, we needed to learn about each company’s business model, evaluate its competitive landscape, construct a model to value it, develop an investment thesis, and create a slide deck with our final buy or sell recommendation. Seeing as we were unfamiliar with our respective companies (and in our case, even the industries themselves), this was a daunting process that could have easily taken several weeks. We had 12 hours.

Preemptively, we had drafted a rough timeline to which we would try to adhere. While helpful in theory, in reality, that plan went out the window. I worked on a taser company and spent additional time refining my slides on my deck. Emma, who chose the EdTech company, had a startup that was still unprofitable. As a result, she spent more time building her model and trying to value the company. Raheel, who ended up with a mortgage insurance company (and got the short end of the stick, in my opinion), spent well over four hours trying to understand the company and the business model in which they operated. It was a race against the clocks, and in the flurry of our work, we even skipped dinner. What time did we submit our final decks? 9 p.m. On. The. Dot.

Bringing it all together

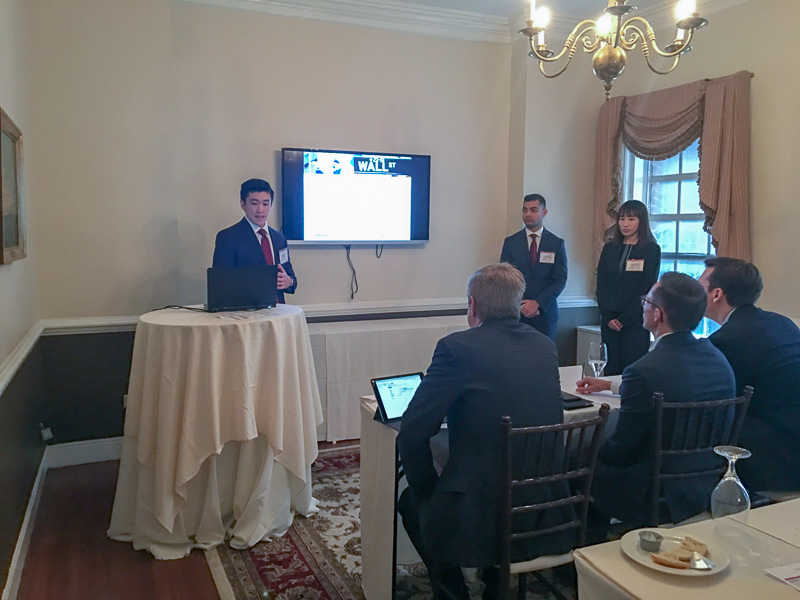

The second part of the experience consisted of presenting our stock pitches at the competition on Friday. Since we had Thursday interviews with some of the sponsoring companies, we ended up driving down to the city on Wednesday. We had two full days after our submission to continue our research, but when you consider the interviews, networking, reception and dinner, we really didn’t have very much extra time to prepare our actual speeches. What this translated to was a very late Thursday night, frantically trying to finalize what we wanted to talk about. Come Friday morning, ready or not, we went in with our heads held high and gave it our best shot.

After presenting all three companies, we experienced very mixed emotions. On one hand, we were relieved that our individual presentations were done and felt very confident in each our performances. On the other hand, we were seriously considering the notion that we would be selected for the finals and, as we awaited the results, the nervous energy came rushing back. For the final round, each team presented a separate company of their choice. Luckily for us, we had already developed stock pitches that we were using in our individual recruitment efforts. In the event we made it to the finals, we decided we would use Raheel’s pitch on Texas Roadhouse.

As we awaited the results, we had a fantastic group lunch and listened to speeches from industry veterans. And then, in the moment of truth, the finalists were announced (in no particular order): Wharton, Booth, and Cornell. After the final pitch, we all waited in suspense. While we received encouragement from other teams in attendance, we had no idea what to expect. After a 50-50 split decision and subsequent debate amongst the judges, Wharton was announced the winner and Johnson the first runner-up. While I wish we could have brought the trophy back to Johnson, I couldn’t be happier with how our team performed and was ecstatic with our result.

Final thoughts and reflections

During the competition, I’d be lying if I said we didn’t have our doubts. We definitely did, and at times, I questioned why the three of us voluntarily subjected ourselves to 12 intense hours of work and four stock pitches. In retrospect, I am incredibly grateful we did. Yes, it was a grueling process, but that’s exactly what made it so rewarding. If it were easy, it wouldn’t be worth doing – the struggle is where you grow.

Finally, I’d like to acknowledge that what we were able to accomplish was all thanks to the second years, the Investment Management Club, and the faculty and resources at Johnson. Without their guidance, mentorship, and support, we wouldn’t have been a finalist at one of the biggest stock pitch competitions in the nation. Thank you all, and Go Big Red!

About Jonathan Woo, Two-Year MBA ’20

Jonathan Woo is a first-year MBA candidate in the Class of 2020. He is the recipient of the Laurence A. Tisch Memorial Scholarship, which benefits students pursuing careers in investment management. Jonathan was born and raised in Southern California, where he we went to school at University of California, Irvine and was in the Honors Program in Economics. Post-graduation, he worked for Merrill Lynch and RBC Wealth Management. At Johnson, Jonathan is a first-year tech analyst for the student managed Cayuga Fund and is active in the Investment Management Club, Old Ezra Finance Club, and High Yield and Restructuring Club. He enjoys hiking, watching the Lakers, and a good craft beer.