Africapitalism: A new Era for Africa

How a summer in Africa changed the perspective of an American MBA student

How a summer in Africa changed the perspective of an American MBA student

by Jerry Petit-Frere, MBA ‘14

Africa as a continent has been an emerging market for the past 20 years. The use of modern day technology has been part of some of the leading advancements taking place in Africa. However infrastructure, food crisis and education still lag behind. What is the solution to help Africa overcome these challenges? According to Heirs Holdings, an investment firm in Nigeria, Africapitalism is the solution that will propel Africa forward. Africapitalism is defined as the private sector’s commitment to Africa’s development through long-term investment in strategic sectors of the economy that creates economic prosperity and social wealth.

In the summer of 2013, I had the privilege of doing my internship through the Tony Elumelu Foundation’s (TEF) African Markets Internship Program (AMIP). The Emerging Markets Institute was instrumental in connecting me with this internship. Institute TEF is a subsidiary within Heirs Holdings. The AMIP program places MBA interns from around the world with SME’s in Africa. I completed my internship at Bookworld, a chain retail book store in Lusaka, Zambia.

If Africapitalism holds true, there still remains a number of challenges for Africa to be successfully developed with a thriving economy. The two main challenges I faced during my internship experience and travels throughout the continent include, the limited availability of industry and market research and the development of human capital.

In my first year at Johnson, the Sustainable Global Enterprise (SGE) Immersion and my leadership roles prepared me well to face these challenges. About thirty percent of my internship project was focused on organizational transformation. Using the frameworks that I learned during my consulting project in my immersion, I was able to thoroughly assess and resolve structural and procedural issues facing the company. Additionally, one of my responsibilities was to create a bonus and incentive structure. For my previous SGE project, my team created a set of tools to assess the motivational factors of a casino in Las Vegas. I was able to take what I learned and create a similar assessment to better understand what motivates Zambians, but in particular Bookworld’s employees. This assessment is the tool which was used to create bonuses and incentives.

Although I was able to make a significant impact as an intern, I walked away with three burning questions that remain open about Zambia and the rest of Africa:

1. Does the concept of Africapitalism present sustainable solutions to the social and environmental issues facing the 47% of sub-Saharan Africans living below the poverty line?

2. Africa is a continent with 54 countries. As Africa develops how does one ensure that the identity of each individual country is protected?

3. What can non-Africans do to support the development of African countries?

In addition to doing business in Africa, I also had the opportunity to enjoy the rich culture, people and food. Overall my experience in Zambia coupled with the potential long term impact that one can have within a short period of time has increased my desire to live and work in Africa. Richard Coyle and the Emerging Markets Institute played a significant role in connecting me with this opportunity and most importantly making this internship a reality. I received the Rob Canizares scholarship through the Emerging Markets Institute which helped support my travel and living expenses. Thank you to the Emerging Markets Institute, Richard Coyle and Rob Canizares for enriching my MBA experience.

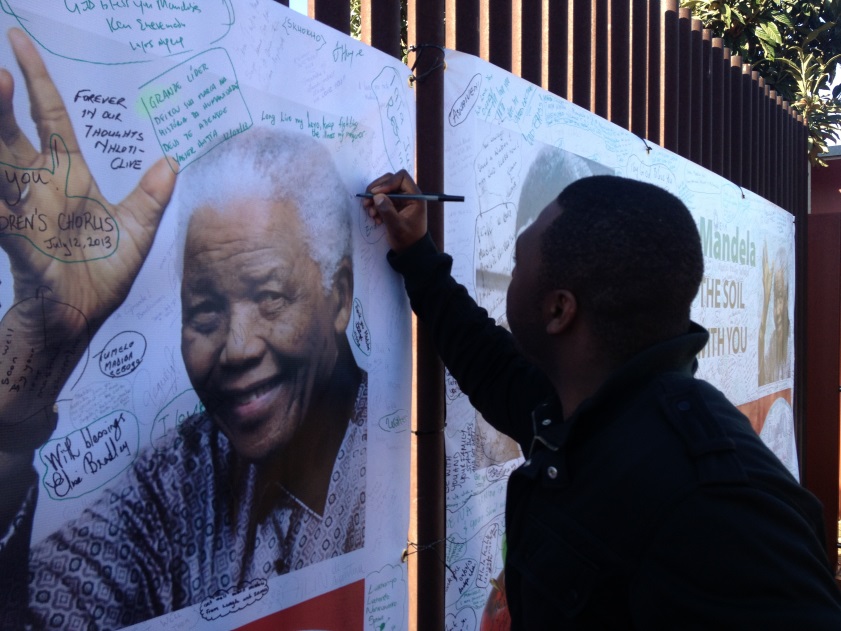

“I dream of an Africa which is in peace with itself.”

Wishing Nelson Mandela a speedy recover at his home in Soweto, Johannesburg, South Africa