Has Argentina Reached a Turning Point or will History Repeat Itself?

Argentina has reached a pivotal turning point after decades of economic instability, but will the recent shift toward a more conservative policy be enough to rebound the economy?

Argentina has reached a pivotal turning point after decades of economic instability, but will the recent shift toward a more conservative policy be enough to rebound the economy?

by Matt Agnello, MBA ’16, EMI Fellow

During Mauricio Macri’s short tenure as Argentina’s president he has unpegged the peso from the dollar allowing a 30% currency devaluation, increased interest rates, reduced the government payroll, and announced a settlement of $4.6B for US bondholders in addition to a $15B issuance of new debt. Although this was a considerable shock as compared to the last administration’s policies, Argentina’s history is rife with economic shifts driven by political change. Studying these past trends may be the best method to understand how the recent reforms will fare in the future.

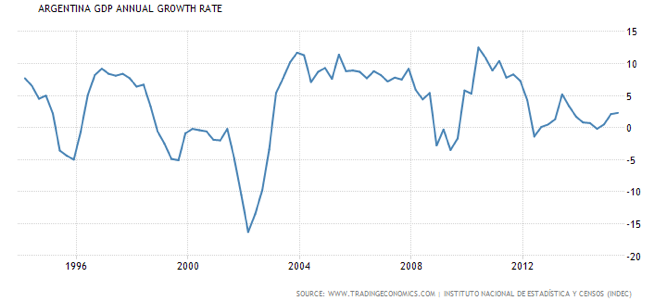

Let’s take a step back to review the last few decades which are defined by erratic periods of strong growth as well as crippling contractions in Argentina’s economy. Over just the past twenty years the rate of growth (GDP annual growth rate) has fluctuated from an astonishingly low -16% to a booming 12% as shown in the chart below.[1] This contrasts sharply with the early successful development of the country’s economy. In the beginning of the 20th century their economy outpaced not only other Latin American countries but also Canada and Australia in terms of per capita income.[2] In fact, in 1913 Argentina was the 10th wealthiest nation on a per capita basis.[3]

Although an unfortunate story, Argentina is an excellent case study of how unstable and polarized political swings have influenced the country’s economic performance. Juan Peron’s tightly controlled socialist regime in the 1940’s resulted first a period of strong growth but the protectionist policies eventually led to stagnation during the 1950-1960’s when other developed economies were booming. Adalbert Krieger succeeded Peron following a coup and introduced a more open trade policy which led to cheap imports and a decrease in domestic GDP causing a 30% devaluation of the peso.[4] Chronic inflation throughout the 1970-1980’s further diminished the country’s wealth and global participation in trade which persisted into the 1990’s.[5] After an unprecedented series of five elections in just a few weeks Eduardo Duhalde emerged as a leader intent on stabilizing inflation and generating a return to growth. However, during the Kirchner regime from 2003-2015 capital and price controls as well as anti-corporate tax policies which favored the working-class eventually led to a decline in GDP to near 0%, the development of a black market currency, and a default on debt which closed Argentina to global sources of financing.[6]

When Mauricio Macri won the presidency in late 2015 with a conservative platform intent on reversing the socialist policies of the Kirchner’s he initiated a series of reforms to reset Argentina’s economy. Macri immediately unpegged the peso from the dollar devaluing the currency by 30% overnight.[7] In addition, a new central bank president and the announcement of a $15B bond issuance shook markets further, but these sharp adjustments may be exactly what Argentina needs to set itself on a path toward a return to growth. In another turn of events, Macri announced in early March a settlement of $4.6B for previously defaulted debt to US bondholders which has allowed the country to return to global financial markets following years of isolation.[8]

The striking economic reforms initiated by Macri have precedence in the many historic fluctuations of political power over Argentina’s past 80 years as we reviewed earlier, but now two crucial questions remain. First, will the new administration’s policies be enough to push the country into recovery? Secondly, will the Macri administration be able to retain office for long enough to ensure their success, or will popular demand shift in favor of a return to left-leaning politics?

Global markets have responded with optimism regarding the recent reforms and many analysts believe Argentina can regain strength in the long-run. This is evident in the strong interest by foreign investors in Argentina’s announcement of the $15B bond issuance due to the high yield of the instruments, low leverage of Argentine debt, and confidence in Macri’s plan.[9] However, challenges continue to mount with a persistent upward pressure on the already 30% inflation rate and a sharp drop in commodity markets which includes their primary export of soybeans.[10] In addition, although Macri has been able to gain support for his policies in the short term his party does not have control over the congress, and a growing social unrest resulting from decades of instability may threaten his ability to continue implementing policies to support his conservative agenda. Improvements in economic conditions over the next year will be crucial for sustained success, because if history is any indication of the future, patience is running thin in Argentina.

References:

Trading Economics (2016, March 10). Argentina GDP Annual Growth Rate 1994-2016. http://www.tradingeconomics.com/argentina/gdp-growth-annual

Yair Mundlak, Domingo Cavallo, Roberto Domenech (1989). Agriculture and economic growth in Argentina, 1913–84. International Food Policy Research Institute. p. 12.

“Argentina Money.” Commanding Heights: The Battle For The World Economy. PBS. Archived from the original on 2011-12-14.

“Argentina”. Encyclopedia Britannica. Archived from the original on 2011-12-14.

Argentina Seen Reporting Strong But Slower Growth In Oct.”. Wall Street Journal. 2010-12-21. Archived from the original on May 25, 2012.

Rathbone, P. & Politi D. (2016, March 4). Argentina: Macri’s change of rhythm. Financial Times. http://www.ft.com/intl/cms/s/0/bd184348-e1f8-11e5-8d9b-e88a2a889797.html#axzz42r0ikWq5

Politi, D. (2015, December 17). Argentine peso falls by almost a third as controls are lifted. Financial Times. http://www.ft.com/intl/cms/s/0/2979e8be-a4e8-11e5-a91e-162b86790c58.html#axzz42r0ikWq5

[1]Trading Economics (2016, March 10). Argentina GDP Annual Growth Rate 1994-2016.

[2] Yair Mundlak, Domingo Cavallo, Roberto Domenech (1989). Agriculture and economic growth in Argentina, 1913–84. International Food Policy Research Institute. p. 12.

[3] “Argentina’s Economic Crisis: An “Absence of Capitalism.” Heritage.org. 2001-04-19. Archived from the original on 2011-12-08.

[4] “Argentina Money.” Commanding Heights: The Battle For The World Economy. PBS. Archived from the original on 2011-12-14.

[5] “Argentina”. Encyclopedia Britannica. Archived from the original on 2011-12-14.

[6] Argentina Seen Reporting Strong But Slower Growth In Oct.” Wall Street Journal. 2010-12-21. Archived from the original on May 25, 2012.

[7] Politi, D. (2015, December 17). Argentine peso falls by almost a third as controls are lifted. Financial Times.

[8] Rathbone, P. & Politi D. (2016, March 4). Argentina: Macri’s change of rhythm. Financial Times.

[9] Rathbone, P. & Politi D. (2016, March 4). Argentina: Macri’s change of rhythm. Financial Times.

[10] Rathbone, P. & Politi D. (2016, March 4). Argentina: Macri’s change of rhythm. Financial Times.