Regional Integration Amid Growing Protectionism

ISSUE NO. 15

by Iwan J. Azis*

Over the last 30 years or so, openness and technological progress have fostered economic integration around the world. Regional integration, defined as cross-border flows among neighboring countries, has also become more intense in some areas. But recent development puts the trend in question. Income inequality is growing, populism and anti-globalization are spreading, and protectionism are on the rise. Across the western world, the right increasingly tends to oppose the social costs of globalization and immigrants, and the left has become more elitist, centrist, liberal and cosmopolitan. The political leaning of the right and the left gets blurred. Both sides claim populism, but one that is different from the postmodernist version where socialism mixed with nationalism.

It is tempted to predict a reversed trend of integration and a collapse of world trade because of this development. Here I argue that it does not have to be so. Increased regional trade among emerging markets (EM) may come to the rescue.

Regional Integration and Cooperation

Rising popularity of regional cooperation since WWII coincided with increased regional integration. Originally established as the European Economic Community (EEC) through the Treaty of Rome in 1957, the European Union (EU) is the most advanced form of regional cooperation and integration. In developing countries, the first non-Cold War ‘bloc’ was in Latin America with the creation of the Economic Commission for Latin America (ECLA) in 1948, later to become ECLAC to include countries of the Caribbean. In Asia, the expression of regional aspirations for integration and cooperation began about the same time with the establishment of UN’s Economic Commission for Asia and the Far East (ECAFE), later to become the Economic and Social Commission for Asia and the Pacific (ESCAP).

The United Nations played an important role to foment regional economic integration in various parts of the world. In the process, deliberate attempts were made to overcome barriers to the cross-border flows by common accord or agreement (e.g., trade liberalization and migration), and in some cases also by jointly managing shared resources and assets. All these reflect increased cooperation among countries.

But “cooperation” and “integration” are not the same. They are often used interchangeably simply because both reflect the unification of economic policies between different countries. Typically, countries enter into an agreement in order to upgrade cooperation through common institutions and rules. When several countries agree to build a joint infrastructure project from which mutual benefits are reaped, cooperation is formed. When they agree to abolish tariff and non-tariff restrictions through free trade agreements (FTA), cross-border flows of goods and services may surge. And when they cooperate to harmonize financial rules and standards, capital flows among them may increase. These are examples where “cooperation” leads to “integration.”

But those cases are rare. In many countries, most infrastructure projects are developed unilaterally although they may be financed by loans from other countries or multilateral agencies. Very few are the result of regional cooperation. Yet, the built infrastructure helps to foster integration by easing the flows of goods and services. In the case EM, the strong trade performance have been supported by intense production network and supply chain. Although it coincides with the rising number of FTA among EM, the two do not imply causality. The utilization of FTA facilities has been always low. The main driver of trade in EM is their unilateral liberalization policy, not FTA or regional cooperation. [1]

In finance, regional integration among EM is much smaller. Cross-border investment in equity markets is less than a quarter of the total, and intraregional flows of bond is less-than 20 per cent. Most cross-border financial flows in EM are with advanced economies (AE). This is understandable because major financial centers are located outside EM. Typically, US investors dominate the equity market and the Europeans in the bond market. [2]

The Outlook Ahead

Financial integration in EM is unlikely to get much stronger in the future. Cross border flows between AE and EM will still be larger. Financial flows of different form, however, may increase with China’s aggressive program of “One Belt, One Road” (OBOR) involving 65 countries with a total population of 4.4 billion by building infrastructure and boosting financial and trade ties. Given the geopolitical factor, however, most projects are likely to follow a bilateral path rather than through regional cooperation.

It is in trade where an irony is currently emerging. For years the US has been known as a stronger proponent of free trade. Their influence over the years has led to a growing number of countries in EM to embrace the free trade policy. China is a notable example especially after joining the WTO in 2001. Ironically, signals coming from the current US administration move in the other direction. President Trump’s assertion following the Davos meeting early this year sums it up: “protection will lead to great prosperity and strength.” US withdrawal from the TPP is seen to send similar signals. And they reverberate globally. The G20 finance ministers meeting last month removed the texts “to resist all forms of protectionism,” something that stood prominently in their last year’s meeting.

As recent as last year, many had already predicted that the world trade will grow even slower than the already protracted rate during the last five years (3 percent per-annum). The reason? World economy’s timid recovery and continued threat of creeping protectionism. With the US’ change of stand, many worries that the prospect will be even gloomier. Will it be so?

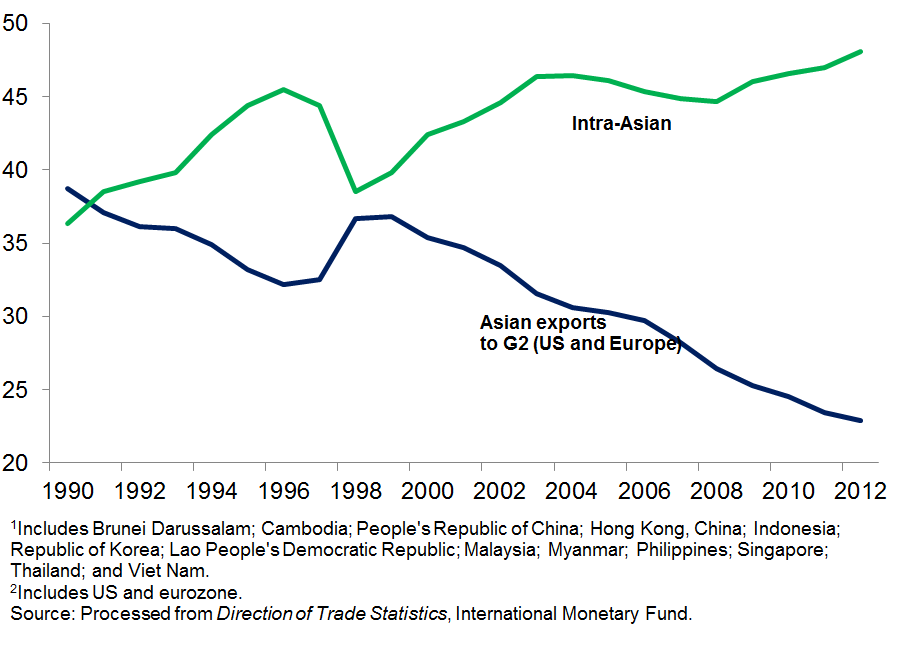

Back during the 2008 global crisis, falling demand in G2 (the US and Europe) has caused the world trade to collapse. Exports of many EM relying on G2 were hit hard. In Asia, however, trade recovered more swiftly than in other EM: weak demand from G2 has been substituted by increased exports to other EM including Latin America, Eastern Europe, Middle East and Africa. But Asia’s most significant increase of exports have been to other Asian countries (see the Chart), reflecting not only a deepening value chain but also the merit of the region’s unilateral liberalization policy. [3] This has emboldened Asia’s integration and has led to a renewed interest in “South South” trade.

Chart: Intra-Asian Trade

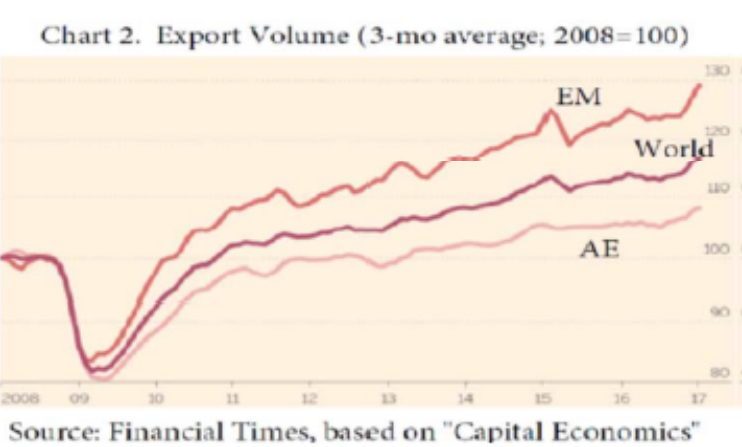

Hence, even if signals of increased protectionism in the US become reality, and the G2 demand falls again, the outlook of world trade does not have to be gloomier. Rising intraregional trade in EM may compensate the fall, implying a change in the distribution of global supply chain. In fact, data for January this year show that in volume terms the global merchandise trade has been expanding at its fastest pace for nearly seven years (2-3 percent higher compared to the preceding three months), precisely due to faster growth of EM trade (Chart 2). But this could happen only if EM do not backtrack on unilateral trade liberalization, rather than regional cooperation. [4] This strategy has worked well in the past. There is no reason to change it now.

[1] (http://www.iwanazis.com/files/documents/Iwan-Azis-Paper-on-TPP-RCEP2013.pdf)

[2] (http://www.iwanazis.com/files/documents/Iwan-Azis-Paper-Cp-Market-Safety-Nets-Oxford2014.pdf)

[3] (http://www.iwanazis.com/files/documents/Azis-Integration-Springer-1-2015.pdf)

[4] (http://iwanazis.com/files/documents/Azis-The-risks-of-regional-integration-Policy-Forum.pdf)

*Iwan J. Azis

Professor of Economics

Faculty of Economics and Business

University of Indonesia

The opinions, beliefs and viewpoints expressed by the various authors in this article do not necessarily reflect the opinions, beliefs and viewpoints of Cornell University and the Emerging Markets Institute, or official policies of the Cornell University and the Emerging Markets Institute

Copyright Statement and Policy: the articles from this series and on the Emerging Markets Institute web site may be freely redistributed in other media and non-commercial publications as long as the following conditions are met. 1) The redistributed article may not be abridged, edited or altered in any way without the express consent of the author and 2) The redistributed article may not be sold for a profit or included in another media or publication that is sold for a profit without the express consent of the author.