Motivations for the Internationalization of Brazilian firms

ISSUE NO. 18

by Fernanda Ribeiro Cahen* and Moacir de Miranda Oliveira Jr.**

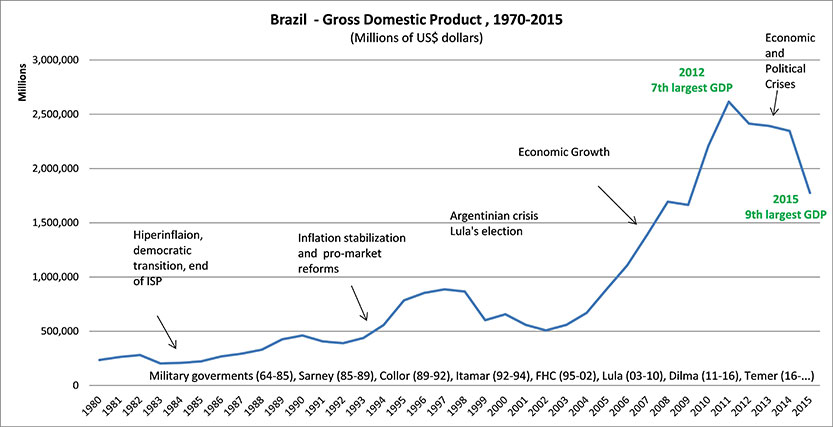

Brazil was one of the world’s fastest-growing economies from 2000 to 2010, but the boom has appeared to slow down since 2011, during which it hosted two of the world’s largest sporting events, including the World Cup in 2014 and the Olympics in 2016. Demonstrations against the Brazilian government’s economic policy decisions and corruption scandals have been spreading around the country since 2013. Despite fierce criticism over her economic policies, President Dilma Rousseff was narrowly re-elected to a second term as president on October, 2014. Brazil’s Senate voted, in September 2016, the impeachment of Rousseff. In spite of the slowdown, Brazil had the world’s 7th largest GDP (World Bank, 2014), behind the US, China, Japan, Germany, France and the UK and it is South America’s largest country in area and population.

The country’s economic rise occurred under the mandate of Luiz Inacio da Silva, who was the president from 2002 to 2011. After impressive growth of 7.5% in 2010, Brazil’s GDP growth fell below 2% in subsequent years, and it ended 2015 in recession. Meanwhile, public spending has surged. Brazil’s gross government debt of 62% may seem moderated compared to Greece’s 175% or Japan’s 227%, but high interest rates of around 14% make borrowing costlier to service (The Economist, 2015).

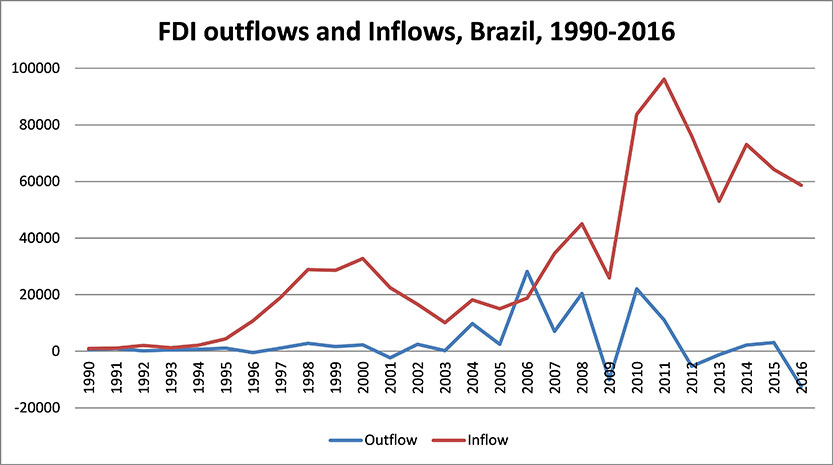

Despite the local economic scenario, the global market seemed the appropriate field for leading Brazilian companies. In 2015, Brazilian multinationals were expanding in global markets, according to a study prepared by the Fundação Dom Cabral (FDC Brazilian Multinational Raking, 2015), which showed that even with the domestic crisis, the top 20 Brazilian multinationals managed to increase their levels of internationalization in 2014. The country observed a growth of approximately 7% in the internationalization index over 2013. From the FDC results, the international strategies of Brazilian multinationals were affected in different ways by the local economic environment. However, most companies (34.5%) said their international strategy was only slightly affected, 19% said it was affected very little and 15.5% claimed that no changes occurred. It should be noted that 29% of companies had their international strategy affected, of which 31% increased their investments abroad and maintained their strategy in the domestic market.

In 1988, Brazil established its new constitution, marking the start of pro-market reforms in the country, with the first democratically elected president, Fernando Collor de Melo, beginning his tenure in 1989 (Fleury & Fleury, 2011). In the early 1990s Brazil faced another highly turbulent period. On the political front, a series of scandals led to the impeachment of the democratically elected President. On the economic front, inflation ascended out of control, reaching more than 2000% a year (Fleury & Fleury, 2011). In 1993, the “Real Plan,” an inflation-fighting plan that finally kept inflation under control, was introduced. It was designed by Fernando Henrique Cardoso, Brazil’s Finance Minister at the time, who would later become the president. The government embraced a pro-market reform agenda. It eliminated the differential treatment of national and foreign capital for government loans and subsidies and initiated the privatization of some state-owned companies (Amann & Figueiredo, 2012).

After the stabilization of inflation and the beginning of pro-market reforms, Brazil’s institutional, political and macroeconomic conditions also stabilized. Brazil enjoyed an average growth of 4.5% until 2011 and a rise in living standards during the first decade of the 21st century. From 2003-2013, over 26 million people were lifted out of poverty and inequality was reduced significantly (the Gini Coefficient has fallen 6% in 2013 to 0.54), although income inequity is still shamefully high (World Bank – Brazil Overview, 2015).

The pro-market reforms stimulated competition and innovation for the most structured businesses and created the bases for the internationalization of Brazilian companies (Amann & Figueiredo, 2012; Fleury & Fleury, 2011). All sectors had to restructure to fit into this new business dynamic, and oil, information technology, pharmaceutical, and aeronautical companies were among those that adapted successfully. In the first decade of the 21st century, incentives were given to favor the transfer of technological knowledge to companies, while several programs expanding credit and subsidies were created to finance innovative companies, especially after 2006. Additionally, programs were implemented to stimulate internationalization and partnerships between universities, research centers and companies. Exhibit 1 presents the evolution of the Brazilian Gross Domestic Product (GDP).

Exhibit 1 – Brazil – Evolution of Gross Domestic Product, 1970 – 2014.

Source: Authors based on Development Indicators data – Word Bank.

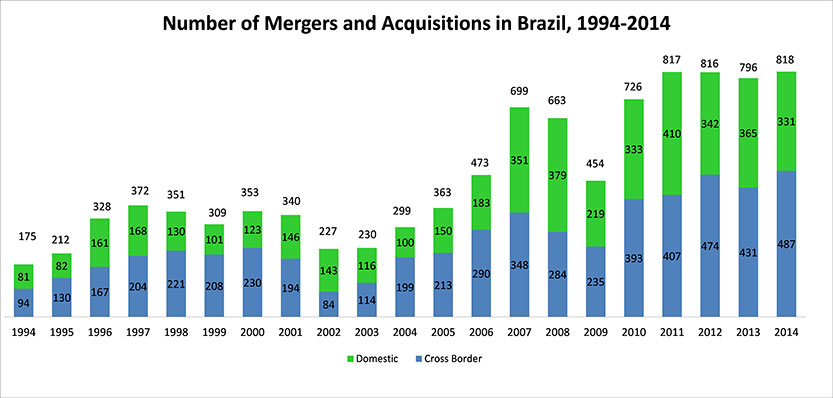

The operation of foreign multinationals speeded up and the relative share of the Brazilian economy in the hands of MNE subsidiaries increased significantly, especially in the services sector. Exhibit 2 depicts mergers and acquisitions (M&As) in Brazil, the intense entry of foreign multinationals doing cross border M&A, and the intense market consolidation of some industries in Brazil.

Exhibit 2: Number of Mergers and Acquisitions in Brazil, 1994-2014.

Source: Authors based on KPMG report

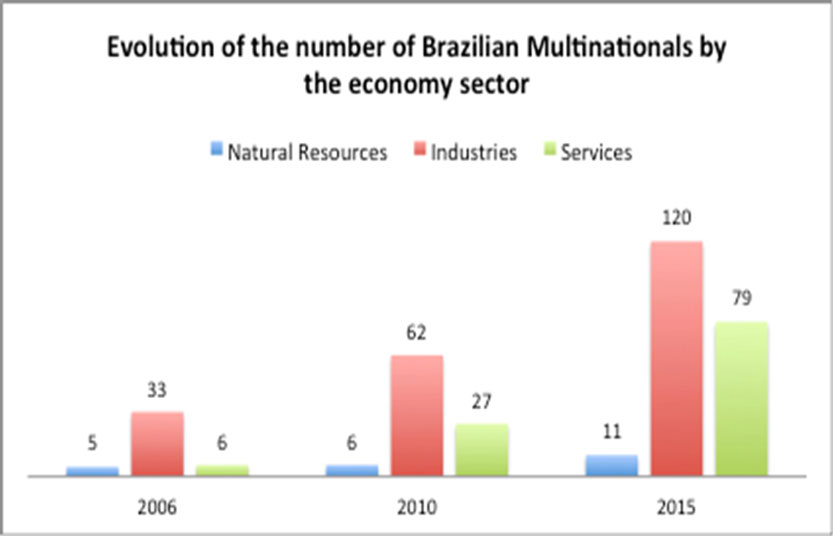

Based on data from Brazil’s Central Bank, it is estimated that there were about 900 Brazilian firms with some form of activity in international markets with more than 10% of their capital in foreign divisions and OFDI greater than US$10 million. GINEBRA (in Fleury et al. 2015) identified 210 of them, to which questionnaires were sent in 2014.

The comparison of the GINEBRA results between the 2006, 2010 and 2014 surveys reveals significant changes in the behavior of Brazilian multinationals. The first is the numerical increase in the three economic sectors, especially service sector companies. See Exhibit 3 for the comparison.

Exhibit 3: Evolution of the number of Brazilian Multinationals by the economy sector, 2006-2014.

Source: Fleury at. al., 2015.

The motivation for internationalization shared by all companies surveyed by GINEBRA seems to center on the need to become more competitive in global markets. According to GINEBRA results, the most important factor for the internationalization of Brazilian multinationals is seeking technological catch-up through acquisitions in advanced markets where they will be exposed to new and more demanding types of consumers. The second most important motivator for internationalization is resource-seeking motivations. It involves seeking markets with natural resources to guarantee the supply and expansion of the company, seeking cheap labor through outsourcing and offshoring processes and the search for financial resources on more favorable markets compared to the conditions prevailing in Brazil (Fleury at. al., 2015).

The factors “access to technology” and “knowledge” stand out as the most important. This consolidated the trend for Brazilian multinationals—and emerging markets multinationals more generally—to drive their internationalization towards capturing more strategic intangible assets and returns (Fleury at. al., 2015).

Exhibit 4 – Brazil – FDI inflows and outflows, 1990-2014 (millions of dollars)

Source: World Investment Report, 2015.

REFERENCES

Amann, E & Figueiredo, P. Brazil. In: Amann, E., & Cantwell, J. (2012). Innovative firms in emerging market countries. Oxford University Press.

Fleury, A., & Fleury, M. T. L. (2011). Brazilian Multinationals: Competences for Internationalization. Cambridge University Press. Cambridge: Cambridge University Press.

Fleury, A. C. C., Fleury, M. T. L., Borini, F. M., Oliveira Júnior, M. D. M., & Reis, G. G. (2015). Gestão Estratégica das Multinacionais Brasileiras. Ginebra Report, EAESP-Escola de Administração de empresas de São Paulo.

Oliveira, M., & Borini, F. (2012). The role of subsidiaries from emerging economies—A survey involving the largest Brazilian multinationals. Thunderbird International Business Review, 54(3), 361-371.

Oliveira. M. (2010). Multinacionais brasileiras: Internacionalização, inovação e estratégia global. 33. ed. Porto Alegre: Bookman.

UNCTAD (2014). World Investment Report 2014: Investing in the SDGs: An Action Plan. New York and Geneva: United Nations.

World Bank (2015). Brazil Overview. Available at: http://data.worldbank.org/country/brazil.

World Bank. (2013). Country and Lending Groups. Retrieved from http://data.worldbank.org/about/country-classifications/country-and-lending-groups#High_income.