China’s excursion to Africa

Chinese investments in Africa are bringing not only sorely needed infrastructure, but concerns about labor standards, wages, occupational health and safety, and workers’ rights.

by Ankit Mandhania, MBA ‘15

China’s domestic growth and increasing global footprint over the last decade has bolstered the idee fixe that China will be the next superpower. Today, it attracts over $2 trillion in direct foreign investment and the rapid growth in recent decades has generated a large appetite for global goods. In particular, it’s the story of China’s increasing presence in Africa that has been drawing significant attention globally.

While China faces slowing growth and an ageing population, Africa on the contrary offers huge potential for growth with its plentiful natural resources and an abundance of young labor at low cost. Africa’s unparalleled demographic profile and growing discretionary income continue to make it the investment destination for global companies and developed economies which are all looking to profit from a young, upwardly mobile consumer base. This growth is being driven by a middle class with increasing personal income and rising demand for consumer goods. Not surprisingly, companies around the world are competing for this market, but despite others’ renewed faith in Africa, Asia remains ahead of its peers. While investment from more developed countries has remained about the same in recent years, China’s flows to Africa have increased significantly. China has surpassed all the nations to become Africa’s largest trading partner, and the economic prospects of both have been increasingly intertwined.

Here are some sample facts about trade between China and Africa in 2012-20131:

- China’s trade with Africa reached $202 billion, double that of the US’s trade with Africa at $100 billion. An increase of twenty times within 14 years, it was only $10.56 billion in 2000.

- China’s investment in Africa was 4.3 percent of its global total and trade with Africa is only 5 percent of its global trade total.

- More than 80 percent of China’s $93.2 billion in imports from Africa were crude oil, raw materials and resources.

- The China Development Bank agreed to provide $3 billion in loans to Ghana, which was almost 10 percent of Ghana’s GDP.

- China’s OFDI stock globally passed $531.94 billion, of which $21.73 billion, or 4.1 percent, was in Africa.

- There are more than 35 bilateral investment treaties (BIT) signed between China and African nations.

Chinese outward foreign direct investment (OFDI) flows to Africa increased nearly 8 times from $317 million in 2004 to $2.52 billion in 2012. Between 2014 and 2020, trade between China and Africa is projected to double and the OFDI to quadruple to about $100 billion. China’s low-cost consumer goods and market foresight appear to have given its firms a jump-start in Africa’s fast-growing retail market. China is investing in a variety of sectors in Africa in the tens-of-billions of dollars. These investments cover everything from real estate to minerals to financial services, and reap a significant return on investment. More than 2,000 Chinese companies have invested in Africa, including in natural resource extraction, finance, infrastructure, power generation, textiles, and home appliances2. It is at times difficult to separate Chinese FDI in Africa from its aid projects, commercial deals and implementation of African government contracts.

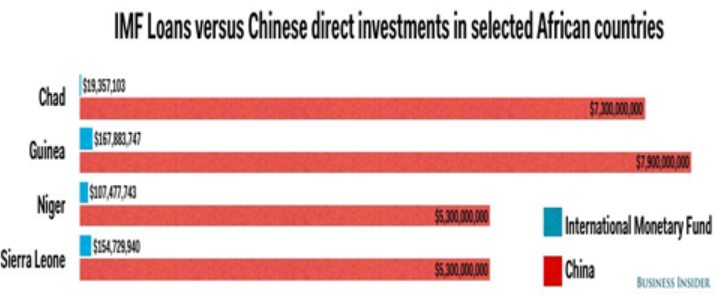

More recently, the Chinese enterprises have shifted their focus from trade to investment. There were only 888 enterprises registered to invest in Africa in 2009, where there have been 2160 firms that registered their outward investments to Africa between 2010 and 2015. China pledged investments of $20 billion last year in infrastructure alone. These mammoth investments have made loans from IMF appear to be trivial. For example, countries such as Niger and Chad owe to China more than 15 times the amount of aid they received from the International Monetary Fund (IMF). Below is a comparison of loans offered by the IMF for development projects in Africa with direct investments by China between 2008 and 2014.

Source: IMF, Business Insider

While this is fueling a lot of excitement about the development in the continent and the influence of China on Africa both politically and economically, there is a growing concern about the impact of it on the African continent’s environment and communities. Africa is treasured for its pristine forests and wildlife untouched by industrialization. However, the large number of Chinese enterprises with their gigantic construction and industrial operations continue to alter that landscape. Unfortunately, the Chinese corporations do not have a very good track record of considering social and environmental consequences and are known for reckless commercial exploitation.

One big objective of the development projects was to create local employment and improve life of communities. However, increasingly there are huge settlements of Chinese population in various pockets of Africa due to the imported labor force and migration of their families. This is causing growing resentment in the African population. Chinese companies have been accused of implementing Chinese labor standards, paying poverty wages, cutting corners on occupational health and safety and refusing basic workers’ rights, such as the right to collectively negotiate through an independent trade union. Chinese investment is mainly intended at sourcing raw materials to feed China’s manufacturing sector, with almost no other local processing than shipping from the mine to the harbor.

Conclusion

In the face of a shrinking labor supply, sluggish growth and excess industrial capacity, China is pushing to upgrade its own economic structure and to increase outbound investment. In this pursuit, it has found a haven in Africa, but this rising economic dependence is not free of contention. Much of China’s FDI in Africa is sovereign loan-financed, contracts are often opaque, and there are tensions around the use of imported Chinese labor in building infrastructure. As China’s impact increases, it can take steps now to make sure it sets a new standard for responsible lending and investment in Africa. It should create more transparency and look for sustainable development.

Africa needs to take a more strategic approach through unification of its countries instead of dealing individually. This can strengthen the continent’s bargaining position in negotiations. Also, countries need to review the trade agreements and create check points to evaluate what is working and what is not. African countries need to diversify their export base across the globe to be less susceptible to spillovers from China.

1 Brookings

2 Ministry of Commerce (MOFCOM)